Content

Accounting is how we tell a story about an economic event or financial transaction, such as a purchase or a withdrawal of money, for example. Periodic financial statements report the impact of the story and are used by leaders of a firm or industry to analyze performance, plan, and respond. Long-Term Assets are parent accounts that contain the original acquisition cost of fixed assets. Debit BalanceIn https://www.bookstime.com/ a General Ledger, when the total credit entries are less than the total number of debit entries, it refers to a debit balance. A debit balance is a net amount often calculated as debit minus credit in the General Ledger after recording every transaction. Accounting For Such TransactionsAccounting Transactions are business activities which have a direct monetary effect on the finances of a Company.

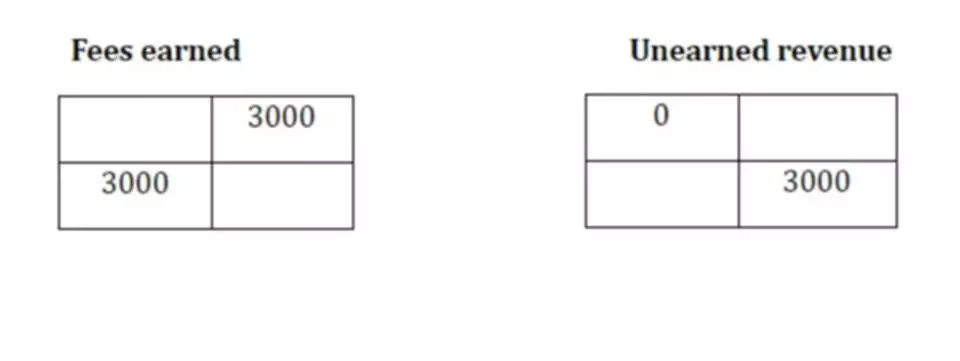

- Examples of deferred unearned revenue include prepaid subscriptions, rent, insurance or professional service fees.

- Contra revenue reduced gross revenue, resulting in net revenue.

- Unlike an asset which has a normal debit balance, a contra asset has a normal credit balance because it works opposite of the main account.

- There can be hidden value in stocks that have a lot of fully depreciated buildings.

A. What is the difference between accounting profits and economic profits? Which of the two concepts is more appropriate for explaining decisions made by entrepreneurs? What is the difference between accounting profits and economic profits? Sales allowance – Allowances are recorded when products sell below the normal price for whatever reason. Sales allowances can occur if there is a discount on surplus inventory or a discount because of product defects. Trade accounts receivable – Trade receivables are the amount owed by customers that have been billed but payment has not been made yet.

Contra account – What is a contra account?

The company will have to maintain separate human resources for such accounting. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. Free Cash Flow The money left over after a company supports operations can be a snapshot of its financial health. Beginner’s Guide to Financial Statements When researching companies, the financial statement is a great place to start. Learn the definition of profitability ratio and analyze examples of profitability ratio. Contra accounts are also applicable for Income Statement accounts.

The equity section of the balance sheet is where the shareholder’s claims to assets are reported. The main contra equity account is treasury stock, which is the balance of all stock repurchased by the company. When a company repurchases shares, it increases the fractional ownership of all remaining shareholders.

Expense Contra Account

The most common contra revenue accounts are for sales allowances, discounts, and returns. Market development funds provided to solution provider partners are one example of contra revenue for vendors. While the other is reducing the balance of the revenue account. In addition, the prior one has a credit balance while the latter one has a debit balance.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- Here is an example of a journal entry you would create when you make a sale .

- The net amount – i.e. the difference between the account balance post-adjustment of the contra account balance – represents the book value shown on the balance sheet.

- The Equity section of the balance sheet typically shows the value of any outstanding shares that have been issued by the company as well as its earnings.

- Contra accounts provide more detail to accounting figures and improve transparency in financial reporting.

- To sum up, the increase in revenue is credit, and the decrease in revenue is debit.

Contra accounts allow us to report the true value of a firm’s assets. The balance of the contra account will offset its parent account while still preserving the value of the transactions recognized in the relating account. The contra equity account reduces the total amount of shareholders’ equity. A contra account is an entry on the general ledger with a balance contrary to the normal balance for that categorization (i.e. asset, liability, or equity). For the purpose of financial statement reporting, the amount on a contra account is subtracted from its parentaccount gross balance to present the net balance. Accounts Receivable AccountAccounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment.

Is a Contra Account a Debit or Credit?

It is a contra-account, the difference between the asset’s purchase price and its carrying value on the balance sheet. When accounting for assets, the difference between the asset’s account balance and the contra account balance is referred to as the book value. There are two major methods of determining what should be booked into a contra account. Key examples of contra accounts include accumulated deprecation and allowance for doubtful accounts. A contra revenue account allows a company to see the original amount sold and to also see the items that reduced the sales to the amount of net sales. Contra revenue account, which is used to record the net amounts and usually has a debit balance, as opposed to the revenue account that records the gross amounts.

- The payment of cash to existing owners is a distribution which increases the contra equity account dubbed “treasury stock account”.

- For example, a business ledger might show a $10 sale of a product, but the product was returned under warranty protection because of a failed feature.

- Contra accounts allow us to report the true value of a firm’s assets.

- You can find your revenue on the first line of your business’s income statement.

- Contra account balances do decrease balances of the main accounts and then the net balance is reported in the financial statements.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

The contra account definition in business accounting is an account used in the general ledger for the purpose of reducing the amount in another account related to it. A general ledger is a comprehensive list of all accounts and their connected transactions in a business.

How to Record a Sales Return for Accounting

Expense accounts and the contra expense accounts with which they are paired are typically combined in the income statement in a single line item, so that readers are not aware that a contra account even exists. Examples of contra equity accounts include the treasury stock account, the owners’ drawing account, and a dividend account. The payment of cash to existing owners is a distribution which increases the contra equity account dubbed “treasury stock account”. This type of account can equalize balances in the asset account that it is paired with on a business’s balance sheet.

Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from corporates, financial services firms – and fast growing start-ups. Liabilities AccountsLiability is a financial obligation as a result of any past event which is a legal binding. Settling of a liability requires an outflow of an economic resource mostly money, and these are shown in the balance of the company. It is a general ledger account to have its balance be the opposite of the original balance for that account. It is linked to specific accounts and is reported as reductions from these accounts. The company should know the reasons for the increase in contra-revenue every month to save extra cost and time. The company can estimate the quality of products based on sales return quantity and amount of product.